tax deductions for high income earners 2019

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. Learn More at AARP.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

. A 10000 cap on deductions for state and local property sales and income taxes. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Ad See how income withholdings deductions credits impact your tax refund or owed amount.

In Georgia however the deduction is only 2000 for individuals and. Deduct Student Loan Interest From. You must meet income limits to be eligible for these credits.

Itemized deduction of 60000 50000 charitable giving 10000 SALT Third Year. It would look like the following. And you cant claim both credits for the same student and the same expenses.

But for many high earners they are unable to fund Roth IRAs due to income limits. State and local taxes. New limits on deductions for some mortgage interest and home equity debt.

The law limits the. TaxAct has a deduction maximizer to help find other potential deductions. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million.

For 2018 you cannot fund a Roth IRA if your income is 135000 or higher for single filers and. Standard deduction of 24000 Second Year. Taxpayers can deduct the part of their medical and dental expenses thats more than 75 percent of their adjusted gross income.

The 4 Tax Strategies For High Income Earners You Should Bookmark

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

What Is A Tax Credit Tax Credits Tax Credits

Canada S Federal Personal Income Tax Brackets And Tax Rates 2022 Turbotax Canada Tips

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Tfsa Vs Rrsp How To Choose Between The Two 2021 Finances Money Managing Your Money Investing

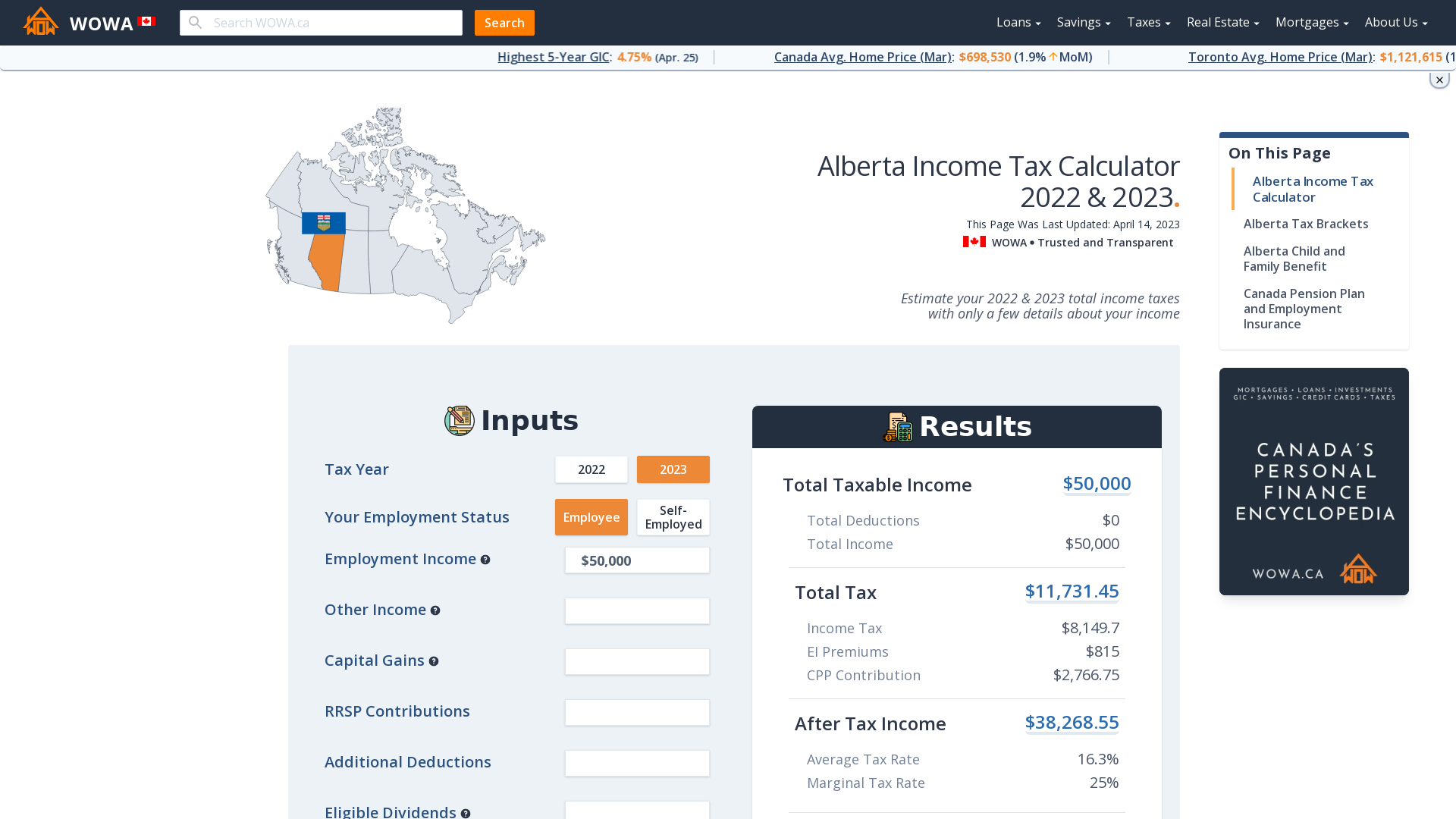

Alberta Income Tax Calculator Wowa Ca

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Who Pays U S Income Tax And How Much Pew Research Center

Publication 590 B 2019 Distributions From Individual Retirement Arrangements Iras Internal Revenue Ser Online Dating Apps Best Dating Apps Dating Quotes

10 Easy Ways To Save Income Tax In India Income Tax Ways To Save Tax

Personal Income Tax Brackets Ontario 2020 Md Tax

How To Use Tax Loss Harvesting To Improve Your Returns Capital Gains Tax Income Tax Brackets Tax

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Publication 590 B 2019 Distributions From Individual Retirement Arrangements Iras Internal Revenue Ser Online Dating Apps Best Dating Apps Dating Quotes

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement